Payment Gateway: Ensuring Steady Cash Flow for Businesses

FinTech is the way forward for businesses across every sector and industry. Carving a niche for your business in the vast digital realm is no simple task. Digitizing a business requires considerable man hours categorizing products/services with a UI/UX design and marketing campaigns that is pliable enough for a specific set of customer base to understand and use. Integrating a reliable and secure Payment Gateway to accept payment from the customer is the subsequent part of digitizing a business.

Digitizing businesses extend to more than simply accepting payments and delivering your product/service to the customer. It involves processing payment from several different payment modes, returns, refunds, vendor payments, and supporting recurring payments, and more. A reliable Payment Gateway offers more than just accepting and processing payments from the customers. How does Payment Gateway aid in processing payments from the customer via. several different payment modes and automation of payment systems? Here is a short read on how integrating a reliable and secure Payment Gateway can benefit your business.

Why should businesses streamline their cash flow?

Cash flow in business, regardless of the size and sector of operation requires constant supervision to ensure smooth functioning of the business. In the digital world, payment transaction is almost never a straightforward, one-way transaction.

- POV of Customer- making payments using several different payment modes, availing offers, placing an order, processing EMI (Equated Monthly Instalment) for different time periods, cancelling an order, requesting exchange, returns/refunds are mostly a single-click process.

- POV of Business- For the business, it is a slightly more complicated process that involves several different stakeholders in the payments industry required to function simultaneously. Accepting and processing payments is only a part of the solution. Streamlining cash flow in and out of the business with ease, while having an easily accessible record is of vital importance to the smooth functioning of a digitized business.

How does Payment Gateway help streamline cash flow?

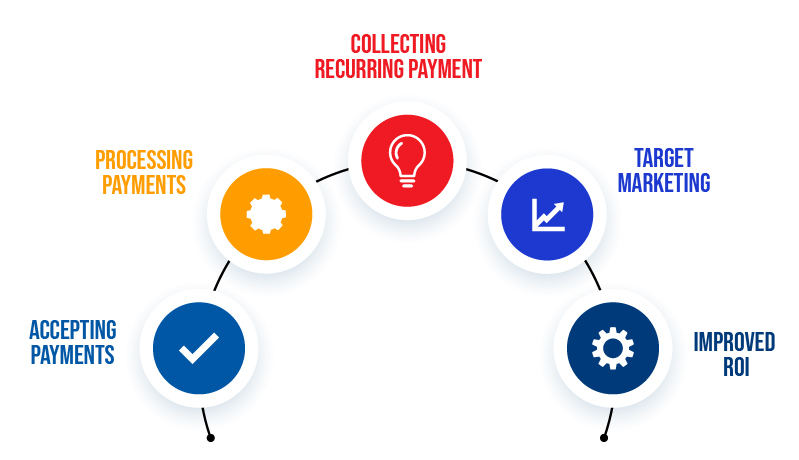

Accepting Payments- Payment Gateway enables businesses to accept payments from customers via several different payment modes. This provides improved flexibility to the customer therefore reducing the cart abandonment rates. Payment Gateway funnels in payments from Debit/Credit Card, Internet Banking, UPI (Unified Payments Interface), Wallets, etc. to the merchant account. At the end of the day, the revenue from all the sales gets collected in a single account, even though the modes of payment may vary with every customer. This allows greater flexibility for customers, clean and efficient accounting for businesses.

Processing Payments- Payment Gateway aids in streamlining cash flow in and out of the business with minimal interference. An efficient Payment Gateway is equipped to handle all elements of digital payments for the business with ease. which include accepting payments via different payment modes, processing returns, refunds, reconciliation, chargebacks, etc. The hassle-free management of cash flow in and out of the business saves cost, time, and effort improving the efficiency of the business operations with increased provision for scalability.

Collecting Recurring Payments- As LendTech and BNPL (Buy Now Pay Later) options are more popular and accessible to customers, collecting recurring payments can quickly become a concern for businesses. Payment Gateway makes the process of collecting recurring payments hassle-free and simple for businesses. This process is equally efficient and flexible for subscription-based businesses that choose to use Payment Forms to receive payments from their customers.

Target Marketing- Marketing, both online and offline, is bound to be cost intensive. Digital Payment Gateway aids in understanding relevant information about your existing customer base. This enables businesses to identify and engage in target marketing campaigns based on the demographic attributes leading to better conversion rates with minimum cost to company and, also enables business to expand existing customer base.

Improved ROI (Return on Investment)- Digital Payment Gateway equips businesses with analytical dashboard that enables the merchants to view every sale over a specific period. This provides the relevant information from both customers and the vendors, to run marketing campaigns, take quick and efficient business decisions that aids in generating improved ROI (Return on Investment).

Digital Payment Gateway facilitates more than just accepting payments from the customers. It helps drive businesses towards better prospects with efficient business decisions, scalable infrastructure, and improved ROI. Pay10 Payment Gateway is the all-in-one solution your business needs. Check out our ultra-efficient Payment Gateway, Payment Links, Payout services, Billing service, Reseller services, and more digital payment solutions.